additional tax assessed meaning

In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance.

Your Tax Assessment Vs Property Tax What S The Difference

This number is called your tax assessment.

. A property tax assessment estimates the fair market value of your property. Just wait a bit and you will receive a letter explaining the adjustmentThat 290 is just a notice of change. A month later I request a transcript and it gave me code 290 additional tax assessed on the same date I.

The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to determine your tax bill. Approved means they are preparing to send your refund to your bank or directly to. The 20201403 on the transcript is the Cycle.

They say all good things come to those who wait. The meaning of code 290 on the transcript is Additional Tax Assessed. Meaning pronunciation translations and examples.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. The tax is charged. Properties can be assessed by different methods depending on whether theyre residential or commercial.

This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question. Please excuse any confusion or grammatical errors since English isnt my first language. The number 14 is the IRS Cycle Week.

575 rows Additional tax assessed. Assessment is made by recording the taxpayers name address and tax liability. Additional tax as a result of an adjustment to a module which contains a TC 150 transaction.

The assessment date is the 23C date. Year of Assessment 2022 is for income earned from 1 Jan 2021 to 31 Dec 2021. It is a further assessment for a tax of the same character previously paid in part.

The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. Many locations offer property tax. Assessment is the statutorily required recording of the tax liability.

23 July 2013 at 1015. This refers to the tax year in which your income tax is calculated and charged. I filed an injured spouse from and my account was adjusted.

From the cycle 2020 is the year under review or tax filing. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due. Additional information that may be obtained from this transcript is the date and amounts of additional payments made by the taxpayer penalties that were assessed and if the return was previously.

Just sitting in received. You can also request a statement of account from the SARS correspondence tab and click on historic IT notices to see your overall balance. The following is an example of a case law which defines an additional assessment.

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property. The assessors market assessed value is based on actual historical sales of similar properties for a specified study period.

Possibly you left income off your return that was reported to IRS. Here is what you need to know about the sample IRS tax transcript with the transaction code 290. Tax is an amount of money that you have to pay to the government so that it can pay for.

I was accepted 210 and no change or following messages on Transcript since. Generates assessment of interest if applicable TC 196. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment.

It means that your return has passed the initial screening and at least for the moment has been accepted. Code 290 Additional Tax Assessed on transcript following filing in Jan. TC 290 with zero amount or TC 29X with a Priority Code 1 will post to a Lfreeze module.

IRS code 290 additional tax assessed which resulted in big amount owed. Additional assessment is a redetermination of liability for a tax. Hi my name is welcome to Just Answer.

A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines. Annual property taxes are determined by multiplying the assessed fair market value against the local property tax rate. What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

Yesterday I finally took all the courage opened the IRS letter that was sent to mynew address by the end of June 2021 then logged into my IRS account. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed. The 23C date is the Monday on which the recording of assessment and other adjustments are made in summary manner on Form 23C and signed by a Service Center.

Tax Assessment means any notice demand assessment deemed assessment including a notice of adjustment of a Tax loss whether revenue or capital in nature claimed by a Brand Company in a manner adversely affecting the Brand Company amended assessment determination return or other document issued by a Tax Authority or lodged with a Tax. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. Accessed means that the IRS is going through your tax return to make sure that everything is correct.

455 37 votes. Market assessed value. The assessment is for income you have earned in the preceding calendar year.

What does your 2019 tax return has been assessed mean. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 290 Meaning Of Code 290 On 2021 2022 Tax Transcript Solved

Your Tax Assessment Vs Property Tax What S The Difference

What Is A Homestead Exemption And How Does It Work Lendingtree

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

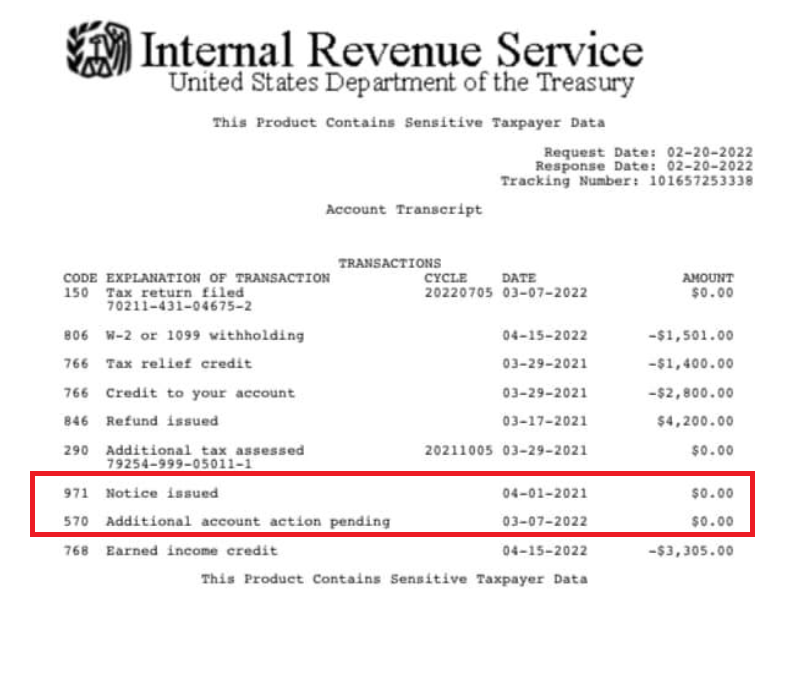

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Irs Code 570 On Transcript 2021 Meaning Explained Afribankonline

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service