iowa capital gains tax exclusion

Starting in 2023 Iowa Code 422721 would be amended to narrow this deduction to the net capital gain from the sale of real property used in a farming business if certain conditions are satisfied. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

2021 Capital Gains Tax Rates By State Smartasset

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue and must be reported on an Iowa Capital Gain Deduction IA 100 form.

. Or elect one lifetime election to exclude the net capital gains from the sale of farmland. When a landowner dies the basis is automatically reset to the current fair market value at the time of death. The current statutes rules and regulations are legally controlling.

The real estate has to have been held for ten years and. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. The test for material participation is borrowed from federal tax law and set forth in Iowa Administrative Code 701-40381.

Iowa Department of Revenue IDOR Issues Several Rulings. Individual income tax exclusion for capital gains narrowed Current Iowa law has complex rules governing the deductibility of certain capital gains. Prior to January 1 2023 the capital gains exemption found in Iowa Code section 422721 is more broad encompassing the sale of farm and nonfarm businesses livestock breeding stock timber and qualified Iowa employee stock ownership plans.

This provision is found in Iowa Code 422721. The law modifies the capital gain deduction allowed for the sale of real property used in a farming business beginning in tax year 2023. The Department projects that the farm capital gains income tax exemption will reduce tax.

This provision applies to tax years beginning on or after January 1 2023. A capital gain represents a profit on the sale of an asset which is taxable. Division III Retired Farmer Capital Gain Exclusion.

There is currently a bill that if passed would increase the. Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the time of the installment saleHerbert Clausen and Sylvia Clausen v. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return.

If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. Capital Gain Loss Iowa Department Of Revenue. 32313 Crawford County District Court May 24 1995.

The amounts entered in this field override the calculated amounts and are included on Form IA 1040 line 23 and in the statement associated with line 23. Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer materially participated for 10 years immediately before the sale and which has been held for at least 10 years immediately bore the sale. Allocate capital gains Force Use these fields to allocate or adjust the amount of capital gains that were coded Iowa with a state use code 3 from federal data entry.

The Iowa capital gain deduction allows taxpayers to exclude from income net capital gains realized from the sale of all or substantially all of the tangible personal property or service of a business which has been held for at least ten years meeting the criteria of one of the six categories listed below. Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10 years but have retired from farming operations can elect an exemption of income from either cash rent or farm crop shares for all years the income is earned. Gains from the sale of stocks or bonds DO NOT qualify for the deduction with the following exception.

By Joe Kristan CPA. Married Separate FilersTaxpayers who filed separate federal returns should report capital gain or loss as reported for federal tax purposes. Iowans who receive stock from their employer as part of an employee stock ownership plan will be able to take a one-time exclusion of the sale or exchange of that stock from capital gains taxes.

In addition a capital gain that qualifies for the deduction. Iowa has a unique state tax break for a limited set of capital gains. A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes.

The IDOR has recently issued three policy letters concerning various aspects of the Iowa capital gains exclusion the application of Iowa inheritance tax to trusts and whether the vehicle trade-in credit requires the same natural ownership. Capital Gains Tax Exclusion. The IRS allows taxpayers to exclude certain capital gains when selling a primary residence.

The Iowa capital gains exclusion Iowa Code Sec. 3 rows You can sell your primary residence exempt of capital gains taxes on the first 250000 if you. 100 adoption of federal QBI.

Elimination of capital gain exclusions except for sales of farms. Before you complete the applicable Iowa Capital Gain Deduction IA 100 form review the Iowa Capital Gain. Iowa Capital Gains Deduction.

Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception. Effective with tax year 2012 50 of the gain from the saleexchange of employer securities of an Iowa corporation to a qualified Iowa employee stock ownership plan ESOP may be eligible for the Iowa capital gain deduction. The Iowa AMT is eliminated.

On the other hand no Iowa capital gain deduction exists for investment property. Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction. For example if a.

Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. Also the statute defines sale of a business as the sale of. Hawaiis capital gains tax rate is 725.

Effective with tax year 2012 50 of the gain from the saleexchange of employer securities of an Iowa corporation to a qualified Iowa employee stock ownership plan ESOP may be eligible for the Iowa capital gain deduction. Iowa moves to a four-bracket income tax with a top rate of 65 and no deduction for federal taxes. Unless the seller materially participates in the farm or business a capital gain deduction will not be allowed.

For 2022 the capital gains tax exclusion limit for the sale of a home is 250000 for single filers or up to 500000 for married couples who file a joint return. Iowa Department of Revenue and Finance Law No. That applies to both long- and short-term capital gains.

The filing separately on a combined return option for married taxpayers is scrapped. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. For the sale of business property to be eligible the taxpayer must have either been employed in the business or materially participated in the business for ten years and held the property for ten years.

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

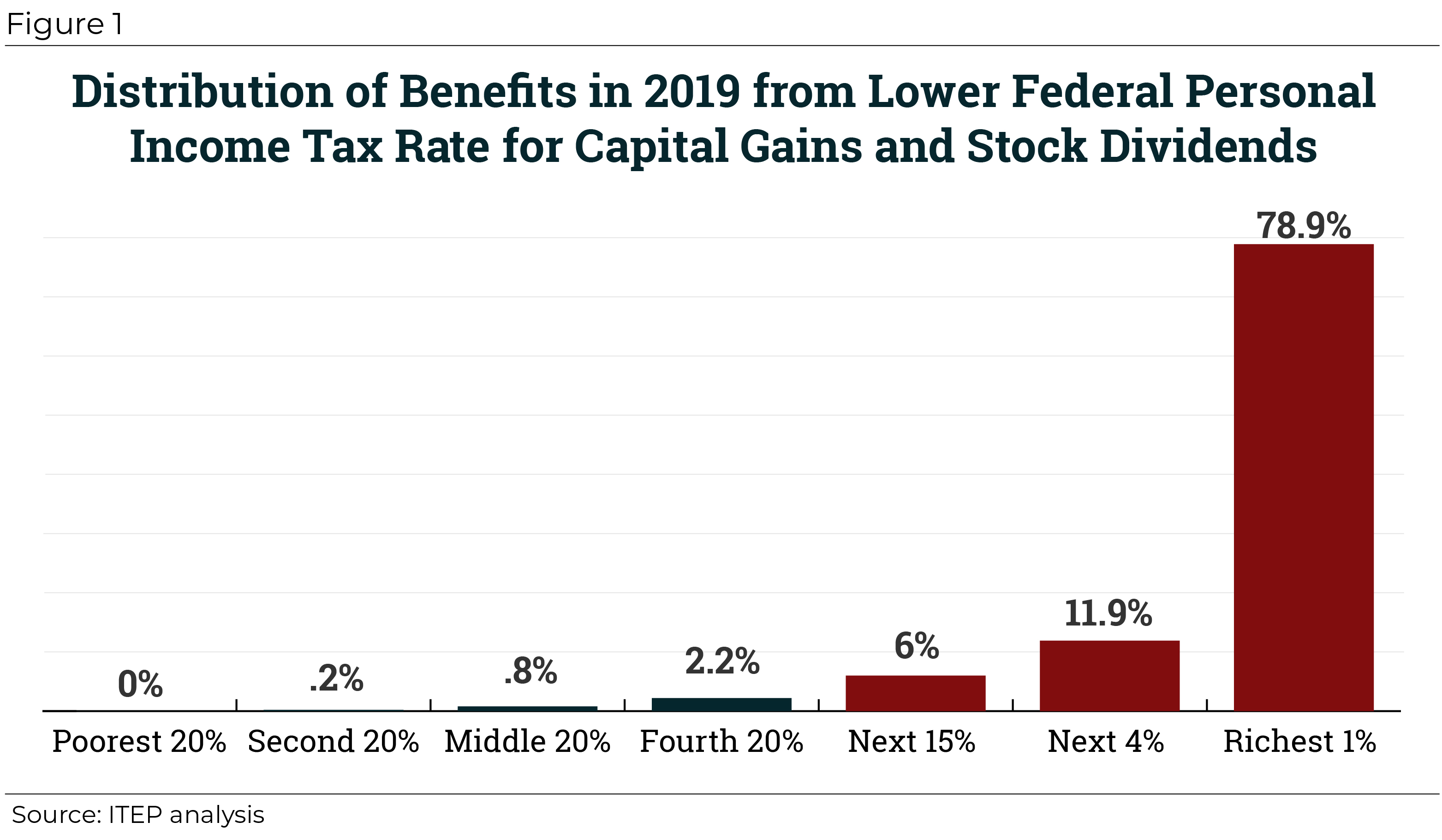

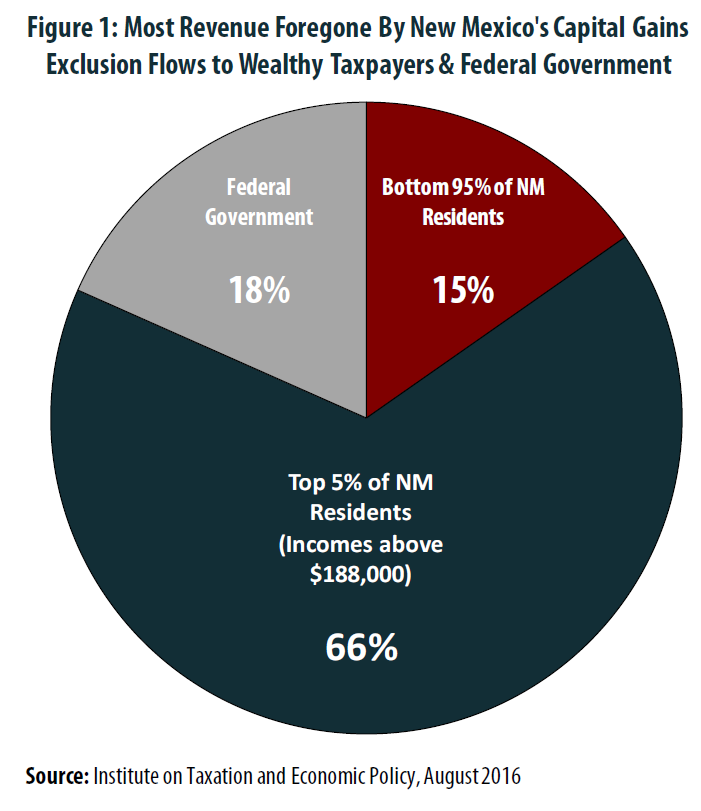

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

What Is Capital Gains Tax And When Are You Exempt Thestreet

No Penalty For Wrong Pan In The Return Http Taxworry Com No Penalty For Wrong Pan In The Return Capital Gains Tax Tax Return Taxact

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

The States With The Highest Capital Gains Tax Rates The Motley Fool

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax Deferral Capital Gains Tax Exemptions

The Folly Of State Capital Gains Tax Cuts Itep

Amendment To Sec 40 A Ia By Finance Act 2012 Retrospective Itat Http Taxworry Com Amendment Sec 40aia Finance Act 2012 Retrospe Finance Acting Investing

Survey U S 133a 9 Actions Tax Law Does Not Permit Http Taxworry Com Survey Us 133a 9 Actions Tax Law Permit Surveys Tax Capital Gains Tax

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

Capital Gains On Gifted Property Or Inherited Property Simplifed Http Taxworry Com Taxation Sale Gifted Inheri Capital Gain Sales Gifts Capital Gains Tax

Capital Gains Taxes White Coat Investor

Capital Gains Tax Calculator 2022 Casaplorer